Summer’s almost here. That means it’s time to start thinking about sun, sand and sun lotion. And converting currency. Unless you have Algbra, that is. Here’s why.

The best bit of a holiday has to be stepping off the plane in a new country. The worst? Sorting your money. Figuring out what exchange rates and transaction fees you’re going to pay is a headache no one needs. But getting it wrong could cost you. Luckily, you have an Algbra card. So you know you're getting a great deal.

Globally accepted.

Your biodegradable Algbra card’s powered by Mastercard. This means you can use it anywhere in the world Mastercard is accepted.

It also means you'll get a good exchange rate. Some banks apply a mark-up to the exchange rate. This stops you from getting the best deal. Not us, though.

Whenever you use your Algbra card to pay in the local currency overseas, you benefit from the Mastercard Exchange rate. This offers great exchange rates.

It’s really simple to get your head around, too. Every time you use your Algbra card to pay or withdraw cash on your holiday, Mastercard automatically exchanges your home currency (Great British Pounds) into the local currency. This means you don’t have to think about the exchange rate at the time of purchase. And neither Algbra or Mastercard will charge you any extra fees for foreign currency transactions.

Tips for getting the best exchange rate.

You already know you’re getting a great exchange rate with your Algbra card – there are a couple of ways to get more bang for your buck.

Check the exchange rate.

Before checking out, quickly check out the current exchange rate for your local currency. This’ll give you an idea of how much you’re paying in GBP. Then you can compare it to other rates on the market. You might be able to get a deal paying with cash. But don’t forget, some ATMs add transaction fees to withdrawals.

Remember, we always use the Mastercard Exchange rate (at the time the funds leave your account). You can check the exchange rate for all currencies here.

Pay local.

Sometimes on your hols, you’ll be given the choice whether to be charged in the local currency or in GBP. Always choose to pay in the local currency. This way you'll get a good exchange rate, and avoid any hidden fees or markups that get added when converting into sterling.

Avoid dynamic currency conversion.

Dynamic currency conversion is a service some providers and ATMs offer, that lets you pay in your home currency rather than the local one. While it sounds great, it costs more than paying in the local currency. The upside to dynamic currency is you'll know exactly how much you're paying in GBP.

To get a better deal, decline the conversion and stick with paying in the local currency.

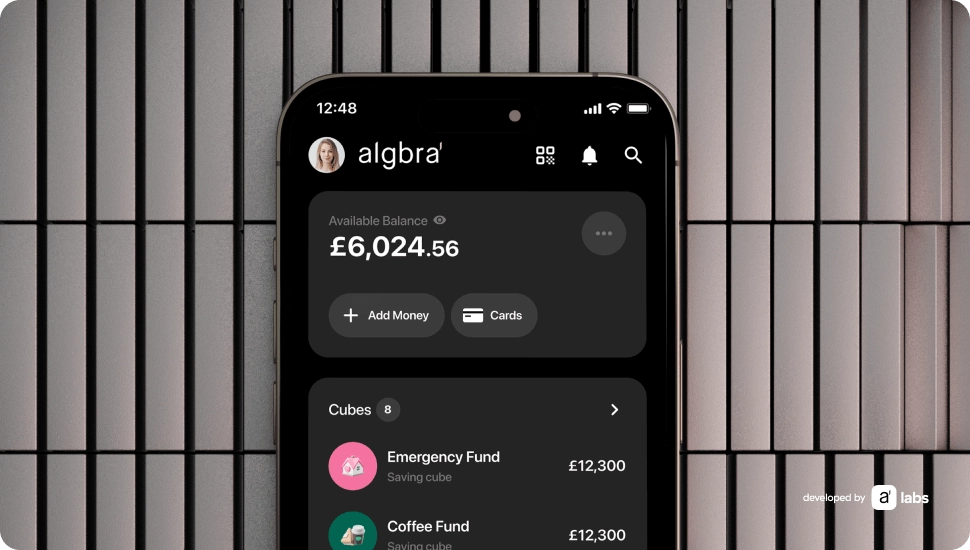

Monitor your transactions.

Don’t forget to keep an eye on your Algbra app when you’re abroad. You can check each transaction to make sure it has been converted to the local currency at the rate you were expecting to pay.

Head into the app, tap on a transaction and check the “Amount we converted”.

If something looks wrong, contact us. We might be able to help you raise a chargeback.

Use your Algbra card.

When it comes to currency exchange rates, not all cards are made equal. So make sure your Algbra card’s the first thing you pack when you’re getting ready to go on holiday. Haven’t got one yet? Then sign up here. You can get a virtual card that you can start using straight away.

What fees does Algbra charge for spending overseas?

None whatsoever. Whenever you use your Algbra card abroad to pay in the local currency, we’ll charge you the Mastercard Exchange rate. And that’s it. There are no hidden fees and we don’t sneak a commission in on top, either.

What do I have to do to use my Algbra card abroad?

Just use it. You don’t have to worry about letting us know you’re going away. Your card will work, wherever, whenever.

Make your holiday 1.5% better.

Getting the Mastercard Exchange rate’s good. Earning cashback at the same time is even better. Take your Algbra card with you to keep on earning cashback on your everyday spending – even when you’re on holiday.

Join the movement.

Holiday in style with the coolest card around. And get a great exchange rate. Download Algbra today to make your holiday even more rewarding.