While you’ve probably heard of green energy, you might not know about green banking. Here’s what you need to know.

To live more sustainably, lots of us are switching to eco-friendly options wherever possible. According to PWC, 76% of us are ready to ditch companies that “treat the environment, employees, or the community” poorly.

We often miss one of the most impactful changes – making our money sustainable. That’s an issue green banking looks to solve.

What is green banking?

Green banking is a new, sustainable way to bank, that focuses on lowering environmental risks and creating a positive planetary impact, while handling day-to-day banking needs. Green banking does this by investing in renewable energy instead of environmentally harmful industries, providing green loans and reducing carbon footprints. And it’s getting more popular.

Environmental and social objectives go hand in hand, so some green banks tackle both climate and social issues (like providing low-income communities with services). By addressing both, green banks can have a much bigger impact.

At the minute, we’re all in the same storm, but sailing in different boats. Climate change disproportionately impacts marginalised communities at every level – from prevention to aftermath relief – despite them contributing the least to it. That’s why green banks look at the environmental and social crises as one issue, not two.

If they don’t, existing inequalities will widen, and could even undo the developmental progress we’ve made. Because low incomes or gross domestic product (GDP) per person means low ability to adapt to shocks like climate change.

Why is green banking important?

Like many sustainable alternatives, green banking is important because it tries to combat the environmental and social challenges we’re facing.

From food to fashion, more of us are facing up to the damage our consumption causes. And the realisation that money is at the heart of it all is sinking in. That’s a massive win for the global sustainability sector, climate and natural environment – because greener finance could be key to creating a more sustainable society and future.

If we’re going to meet our climate goals, “financial cooperation” is essential, because money makes the world go round. How we spend it has a major impact on the climate. A staggering 72% of global greenhouse gas (that’s GHG) emissions are caused by household consumption.

And finance has an even bigger part to play. It’s not only what we spend money on, or invest in. Where we bank also makes a big difference.

What high street banks do with your money.

You might not know the money in your bank account doesn’t sit there idly, waiting for you to spend it. High street banks actively invest your money. And you don’t get a say in what they invest it into.

Your bank could be using your money to fund industries that directly oppose your values, like gambling, tobacco and arms. They could even be using it to profit from environmentally unfriendly practices.

Since signing the Paris Agreement on climate change back in 2015, the 60 largest banks alone have invested over $5.5 trillion dollars in unsustainable energy. This flies in the face of tackling climate change – despite many banks claiming they want to be “net zero”.

To be fair, this issue isn’t exclusive to banking. It’s a worryingly common trend seen across industries. After taking a data sample from different business sectors, the European Commission estimates 42% of sustainability claims are exaggerated, false or even deceptive. Some could even be considered unfair commercial practices under EU rules.

The impact of green banking.

While these numbers sound alarming, they contextualise research by Make My Money Matter. It revealed it’s 21x times more impactful to “green” your pension than to go veggie, stop flying and switch to renewable energy, combined.

To keep global temperatures below the 1.5 degrees tipping point, we need to speed and scale up the green transition. The approach many high street banks are taking won’t help us achieve the most pressing issue humanity’s ever faced.

To create a fair, empowered and sustainable future for society, banking has to become more ethical. It needs to start placing people and the planet before maximising profits.

It’s not all doom and gloom. Many banks are getting the message and are taking steps to become more green. They’re investing more in sectors like sustainable infrastructure and renewable energy, offering loans to environmentally conscious businesses and reducing their carbon footprints. More banks are even providing their customers with carbon tracking and offsetting tools to help them minimise the impact of their spending.

Green banks know time is key to preventing catastrophe. They’re not just increasing the scale of their green strategies, they’re doing it as quickly as possible to limit environmental and social damage and trying not to make things any worse, while capitalising on the opportunities that a green transition creates.

The cost of climate change.

Without a green transition, the World Bank believes climate change could push 100 million people back into poverty by 2030. That’s only 7 years away. It could drive 216 million people to migrate within their own country by 2050, and create hotspots of internal migration as soon as 2030. Things will only get worse from there.

Over 1.3 billion people (mostly in developing countries) are trapped on agricultural land that’s degrading. This increases their vulnerability to slow-onset disasters, like drought, desertification, food insecurity and famine. Scary, when you consider 70% of the world’s poorest depend on natural resources for all (or part) of their livelihoods. Climate change impacts could cause 600 million more people to face food insecurity and malnutrition as agricultural systems collapse.

As if the human cost wasn’t enough, the monetary impact of climate change is staggering. Global natural disaster losses in 2022 alone totalled $270 billion. If banks continue their business as usual approach and ignore the implications of their investments, it’ll end up costing the world’s economy $178 trillion by 2070. By 2100, global GDP could be 37% lower than it would be without the impact of global warming (when accounting for the effects of climate change on economic growth).

Choosing not to reduce GHG emissions will cost more than tackling the impacts of climate change. The economic damage continued warming creates by far outweighs the cost of preventing the emissions right now.

Making a Just Transition.

A Just Transition is sustainable and equitable But achieving it isn’t easy. According to Doughnut Economic metrics, no country has achieved an equitable and empowered society without overshooting on planetary boundaries.

To achieve our climate goals, it will cost $7 trillion a year. With almost 75% of the current climate funds coming from the private sector, the scaling and speeding up of further finance from the private sector will prove essential.

Investing in green banking isn’t burning money, it’s good business. The Global Alliance for Banking on Values found that banks prioritising environmental and social sustainability have outperformed those that don't over the past decade.

Pivoting to a greener future opens up an estimated $12 trillion in market opportunities. A $1 investment in a green economy returns, on average, $4 in benefits. Put simply; green banking pays back in more ways than one.

Green banking is growing. It’ll play a crucial role in addressing society’s biggest environmental and social challenges. Living sustainably is not to be downplayed (it comes with its challenges, but the rewards are more than worth it) but greening your finances is the easiest and most impactful thing you can do today that makes an actual difference.

If you’re looking to kickstart your green banking journey, head over to bank.green to uncover sustainable, fossil-free banking alternatives. You might even spot a familiar name there.

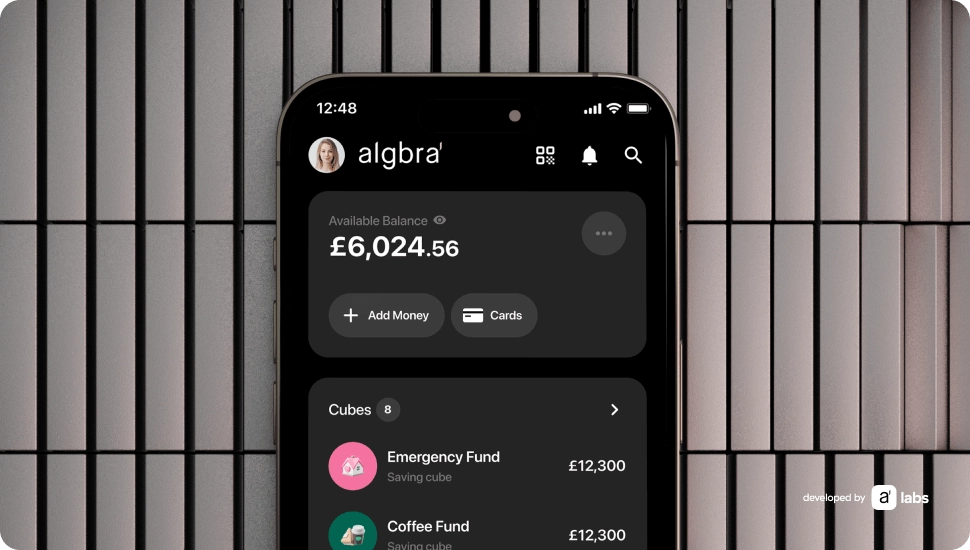

Start making your money greener today, with Algbra.

Algbra’s the most rewarding green money app that can help you make your finances more eco-friendly. And it pays off, in more ways than one. Open an account in minutes to protect your money from unethical industries, access carbon offsetting tools and start earning cashback on your everyday spending.