As we move towards a cashless society, there’s less money in our wallets. Is that a bad thing?

What is a cashless society?

A cashless society is one where physical coins and banknotes aren’t used in financial transactions. Many wallets only contain payment cards these days. Because all around the world, people, businesses and entire countries are going cashless. They’re not ditching money, though. They’re ushering in a new era of emoney by waving bye-bye to notes and coins. Will they get their money’s worth? Here are the pros and cons of a cashless society…

Pros of a cashless society

- Quicker, easier transactions

- Lower risk of crime

- Increases financial inclusion

- Better for the environment

- Easier to travel abroad

Cons of a cashless society

- It’s easier to budget with cash

- Greater risk of cybercrime

- Leaves people behind

- Makes donating harder

- Cash can hold sentimental value

Pro: Quicker, easier transactions

Ever had to break into a tenner because you were a couple of pence short? Or found your wallet bursting at the seams from too much loose change? Worst of all, been stuck behind that guy who holds everyone up as he pays for everything with change…?

A cashless world could solve all your problems. With digital payments, you always have the right amount to hand, so there’s no more digging for coins and no more waiting. You can check out with a tap and don’t even need your wallet, because your cards are on your phone.

Con: It’s easier to budget with cash

Budgeting can be easier with physical cash. You can lay it out and sort it into pots to keep you from overspending.

It’s easier to overdo it when you can check out with a tap. But with physical cash, you can only spend the money you have on you. Unless you borrow or withdraw more, of course…

Pro: Lower risk of crime

There’s a reason bad guys in films get paid in cash-stuffed briefcases... Because cash makes crime easier. Bank robberies, burglaries, extortion and corruption plummet when physical cash is harder to come by (according to Swift Money).

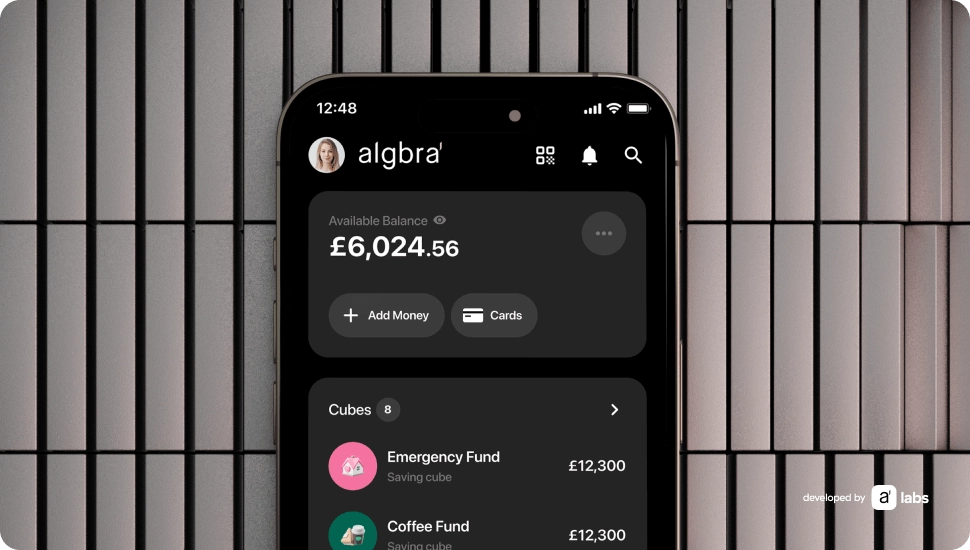

When cash is stolen from your wallet, it’s gone. But if your card’s missing, you can block it from your mobile banking app. With Algbra, you can log into the app and freeze your card immediately, wherever you are.

Criminals like cash, because it’s untraceable (thanks, Access to Cash Review). But digital payments leave a trail, which can make fraudsters think twice.

In 2016, the ECB announced it would stop producing €500 banknotes to limit fraud and money laundering. Cashless payments help prevent money laundering, as they remove the opportunity for circulating fake notes.

Con: Greater risk of cybercrime

When money’s involved, crooks are never too far behind. Cybercriminals are smooth operators, with cunning ploys like:

- Hacking

- Phishing

- Malicious software

These schemes can come in all shapes and sizes, and change all the time. As our money becomes increasingly digital, their window of opportunity widens. Looking to stay safe online? Check out the National Crime Agency website.

Pro: Increases financial inclusion

The move towards a cashless society can increase financial inclusion because mobile money accounts are so easy to open, unlike traditional bank accounts.

They aren’t just simple to set up – they make people's lives easier, especially in developing countries. In Bangladesh, for example, mobile money accounts enabled almost 50% of adults to send or receive a digital payment in 2021.

In the UK, digital finance apps have also brought more people into the financial system. According to the World Bank, 99% of UK adults made or received a digital payment in 2021.

This is because of how easy it is to open an account. Take Algbra – all you need to open an account in minutes is a UK mobile number and a valid ID document.

Con: Leaves people behind

A cashless society is all well and good – until your internet drops out. Digital payments could leave some people behind, like those in areas where the internet is less accessible, or people who aren’t as tech-savvy as the Gen Zers out there.

If there was to be a widespread blackout, accessing your money would become a real problem.

As a society, we’re becoming increasingly reliant on technology. And as we edge toward a cashless future, financial literacy is more important than ever. That’s why Algbra created Chai Mama – an open space for women to talk about finance and learn from financial professionals.

Pro: Better for the environment

Going cashless is better for the planet (and we’re all about creating a sustainable future). Each debit card transaction contributes just 0.00378 kgCO2e to climate change. That means cashless transactions have a minor impact on the planet. Cash? It has a colossal carbon footprint, given the:

- Energy needed to produce banknotes and coins.

- Emission of harmful chemicals and greenhouse gases (GHGs) during the manufacturing process.

- Emissions caused by transporting physical cash around the world.

Cashless isn’t without its issues, though. Some payment cards are made from PVC – which produces tonnes of GHG emissions and doesn’t biodegrade.

Thankfully, Algbra’s physical cards are fully biodegradable and the virtual ones are, well, virtual.

Con: Makes donating harder

Ever wanted to give a few coins to a charity collection box, but didn’t have any change? At these times, physical cash is handy, because you can easily donate whatever you can spare. Recently, we’ve seen charity fundraisers carrying a contactless card reader alongside the more traditional collection box. A glimpse of the future?

Pro: Easier to travel abroad

Sorting out your finances can be a nightmare when you’re trying to find an ATM or bureau de change abroad. Things only get worse when you realise they’ve ripped you off. Payment cards (like Algbra) make your trip easier because they use Mastercard, which is globally accepted.

With exchange rates, not all payment cards are born equal. When you buy something abroad (or online) in a foreign currency, some banks add a mark-up to the exchange rate.

With your Algbra card, you’ll always receive the Mastercard Exchange rate – without any extra fees or charges. These great exchange rates could add up to an extra meal on your next holiday. Tasty.

Con: Cash can hold sentimental value

Weird as this sounds, cash looks cool. Dollars, euros or rupees make a great keepsake from a trip. Banknotes can feature beautiful designs that tell you more about a country’s culture.

It’s still big news when a new note is launched (think back to when the Bank of England added Alan Turing to the £50 note).

And was there a better feeling than finding a cheeky fiver from Nan in your birthday card? Creating those memories will be a lot harder in a cashless future.

The future of money

Whether you’re already cashless or clinging firmly to your coin collection, money is changing. You can stay ahead of the curve by downloading Algbra today.