Tucked away on page 76 of the Kalifa Review of the UK fintech industry, which Chancellor Rishi Sunak endorsed last month, is a lone reference to the UK’s “traction in Islamic Fintech” in the Middle East and north Africa.

The 108-page review’s scant interest in the sector reflects the fact that sharia-compliant fintech “is still a bit under the radar”, according to Harris Irfan, chair of the UK Islamic Fintech Panel. “Despite the UK’s creativity and talent in the sector, there’s not the capital to match.”

However, a host of start-ups are hoping to reverse the trend in time to ride an expected wave of growth, and are being encouraged by politicians who see it as a way to boost London’s status as a global financial hub after Brexit.

Islamic finance companies provide similar services to conventional banks, but their products are structured to comply with traditional Islamic laws such as a prohibition on charging interest.

Islamic fintechs currently account for less than 1 per cent of annual fintech transaction volumes globally, according to the 2021 Global Islamic Fintech report, but the figure is on track to more than double from $49bn to $128bn by 2025, outpacing the growth rate in the wider fintech sector.

US-based investment platform Wahed Invest has arguably come closest to becoming the first truly global Islamic fintech, with more than 150,000 clients in 130 countries and a valuation of more than $100m. In December it agreed to buy British start-up Niyah, which is building a digital challenger bank, to fuel its quest to become the “leading, one-stop-shop” for sharia-compliant financial products.

Niyah underwent a soft launch in January 2020 and, according to the company’s co-founder Ali Abdulkadir Ali, is planning to launch a “combined proposition” with Wahed Invest by the end of 2021.

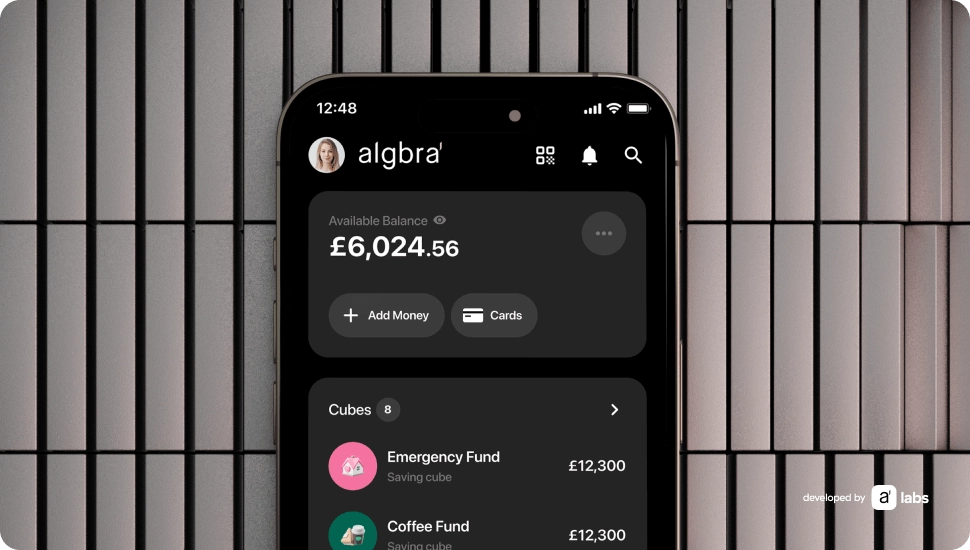

Meanwhile, UK-based algbra (which #fintechFT profiled two weeks ago) has raised £3.75m of seed funding and is mooted to begin operating its first bank accounts later this year with plans to roll out a retail investment platform shortly afterwards.

Zeiad Idris, algbra co-founder, hopes his brand can appeal to an otherwise “completely untapped” market. The first step for algbra is to launch a retail banking product aimed at the more than 3m Muslims in the UK, the median age of whom is just 25, meaning they are a “natural fit” for fintech.

“Young British Muslims have never been offered a relatable finance brand that matches their ethical outlook on the world,” said Idris, pointing to how Qatar-owned Al Rayan Bank, the UK’s biggest Islamic finance institution, has just 90,000 customers.

Niyah’s Ali agrees, and believes that UK-based Islamic fintechs will have a competitive advantage worldwide as a result. “In the Middle East, Islamic finance is a default so it means they’re less likely to go out of their way to innovate for the global market,” he said.

That global market is the ultimate prize for both brands: nearly half of the world’s 1.7bn unbanked adults are Muslim, according to the World Bank, and four of the top 10 fastest-growing economies worldwide are Muslim-majority countries, according to the IMF.

According to Idris, the UK’s cultural links to those countries, a number of which are Commonwealth nations, are a “natural gateway to a global brand”.

Global success will require avoiding problems that have slowed down earlier start-ups such as StrideUp and Primary Finance — property finance companies that saw their growth stall after struggling to raise enough capital, according to Islamic Finance Guru, a comparison site.

However, they will at least have the support of high-profile figures who see growth as another way to boost the UK’s position in the wake of Brexit. In March, Sunak issued the UK government’s second sukuk — a sharia-compliant government bond — an event which he said was “cementing the UK’s position as the leading global hub for Islamic finance outside the Islamic world”.

Sajid Javid, the UK’s first Muslim chancellor, who was the mastermind behind the country’s first sukuk when serving in the Treasury in 2014, said the political will is “absolutely there” to foster Islamic fintech in London.

“Supporting Islamic fintech as a way of further enhancing our status as a global financial hub naturally fits with the post-Brexit agenda,” Javid told #fintechFT. “We’ve got the technical knowledge, physical infrastructure and institutions to support fintech in general, but also the homegrown talent and cultural ties to build world-leading fintech brands.”