Make a profit and make the world a better place — can fintechs do both?

Fintech is heavily focused on money… so can it be a force for good?

This was just one of the topics discussed at last week’s roundtable, produced in partnership with Mastercard.

Sifted senior reporter Isabel Woodford interviewed a panel of founders and executives on everything from how fintechs can create products tailored to underserved groups and why partnerships are essential when it comes to scaling. Joining us were:

- David Jones, head of fintech at Mastercard UK&I

- Matt Oldham, CEO and cofounder of Unizest, which offers workers and students who are new to the UK an ecurrent account via an app

- Jayne Sibley, founder of Sibstar, a debit card and app designed to help individuals living with dementia and their families

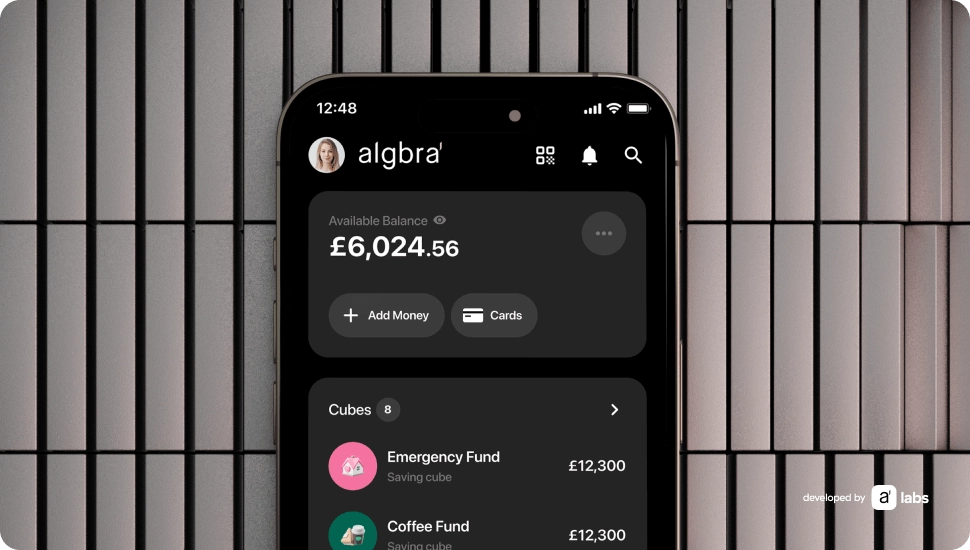

- Nizam Uddin OBE, chief strategy officer at Algbra, an ethical finance app

Here’s what we learned.

1. Focus on what’s best for your customer

Fintechs often design services for an underserved audience, in order to capture market share. But what sets apart a fintech for good company?

Jones said in the past, payday loan companies provided their customers with a service that they needed, but one that wasn’t necessarily in their best interests. Fintechs for good need to operate with external accountability, with the customer always in mind.

Sibley, for example, created Sibstar out of personal necessity to help her parents, who both live with dementia, to manage their money. When building Sibstar, she did a lot of research with potential users to make sure the product met their needs.

“I think focusing on your end-user and bringing them into the development process is an important feature for fintech for good. We need to have a financially sustainable business, but equally important is having that positive social impact on the families we are here to serve. For us, those two things have equal standing” — Jayne Sibley, Sibstar

2. It’s not easy for incumbents to support the underserved…

Traditional high street banks are designed to serve a very general population, and Oldham said users with specific needs — whether that be a disability or unique requirements based on financial background — may face the “computer says no” problem as some banks were not designed with them in mind.

He clarified that it’s not because banks are mean spirited — it just comes down to regulatory and commercial restrictions. They have cost pressures like branches to maintain and shareholders to answer to.

Uddin said many communities had lost faith in traditional banks after the 2008 recession, making it difficult to engage underserved customers.

“If you look at the structure of a lot of those banks, it’s impossible for them to turn around and be nimble and agile in a niche. There has also been a move towards automation with legacy systems, which makes it very difficult for an individual to make an individual choice about a particular customer with an unorthodox need” — Matt Oldham, Unizest

3. …but they still have a key part to play

Oldham said banks still have a crucial part to play in the financial ecosystem. He noted that many are household names with a physical presence on the high street which makes them really accessible to a large number of people.

He added that incumbents have upped their game since challenger banks came along — banking apps, for example, might not exist without the pressure from neobanks. Stiff competition is forcing them to evolve to the customer’s needs.

Jones said that when it comes to “social good” many of the people running the banks are keen to find more ethical ways of doing business.

“The more we succeed in focusing on a values-based way of doing things, the more the traditional banks want to be involved… They would very much like to do good things and make people’s lives better and I think we will find them more open to collaboration” — David Jones, Mastercard

4. Collaborate, collaborate, collaborate

As well as collaborating with high street banks, startups should think about working together with other groups. Algbra, for example, has partnerships with community-based organisations, such as a women’s football team. Uddin said investing in projects like this, in the long run, allows startups to connect with their customers.

And it’s not just community groups — partnerships between big tech and fintechs can be a major catalyst to scaling, giving them reach, knowledge and access to networks. For example, Sibley did not come from a banking background when she set up Sibstar, and finding partners who understood finance was essential. She said working with Mastercard, for example, opened many doors and was a key element in attracting customers.

“Collaboration for us is critical…our business is driven by our own absolute personal drive to make it easier for families like mine and that is a real distinction between us and other fintechs” — Sibley, Sibstar

5. How to be commercial while being good

Making a difference in the world is a noble endeavour — but it’s pretty hard to do if you’re unable to make a profit or attract investment to keep yourself running.

Oldham mentioned Unizest has VC backing, but that ESG investment is a big growth area for all types of investors. Large pension funds, for example, need a certain proportion of their holdings to fall under the ESG category.

Sibstar is at the very early stage of raising capital and is mostly funded by grants. Sibley said it can be challenging to be profitable with a purpose. She added startups like hers can be mistaken for a charity, but don’t have the same methods of funding as a charity does.

“A purpose-driven fintech focused on underserved communities absolutely can become a unicorn. We don’t see a tension between purpose and profit. Increasingly we are seeing a whole swathe of money — venture capital, private equity, sovereign wealth funds — all really focused on this space” — Nizam Uddin, Algbra

To find out more about the Mastercard Developers portfolio and how Mastercard is providing the tools and resources for every fintech company to turn their bold ideas into reality, visit their website here.

Click here to read original article.