As the financial technology industry continues to expand at an exponential rate, the opportunity for colossal profits increases year-on-year. Often, businesses see a tension in the drive to boost income and the duty to be socially conscious. Striving for carbon neutrality and improving tech accessibility can be expensive pursuits, which can reduce the corporate appetite to bring about these positive changes.

This is a particularly important issue for the fintech industry, due to the seemingly boundless possibilities presented by innovative technology. A good example of this is the role of cryptocurrencies and their underlying technology to provide cheaper and faster alternative to exorbitant Money Transfer Operator costs. This can help migrant workers that need to send remittances home to help struggling friends and family, a large portion of which is taken away in exchange rate fees.

These payments are often sent to countries that are suffering from national emergencies, where families need the financial aid to survive in war-torn cities or areas ravaged by natural disasters. The importance of remittances extends far beyond individual households, as a number of developing economies depend heavily on this funding from overseas. Jamaica, for instance, relies on remittances to constitute 24% of its entire GDP. Equally, over one tenth of the yearly GDP of emerging nations is made up of remittances.

In order for fintech companies to connect with the members of diaspora communities that regularly send remittances, they need to improve their diversity. At the moment, too few members of these communities are aware of the potential opportunities offered by fintechs such as blockchain payments. It has been repeatedly highlighted that companies with greater diversity attract significantly better diaspora engagement. Only 3% of people working in the fintech industry are black, which provides an obstacle for fintech companies trying to reach these communities.

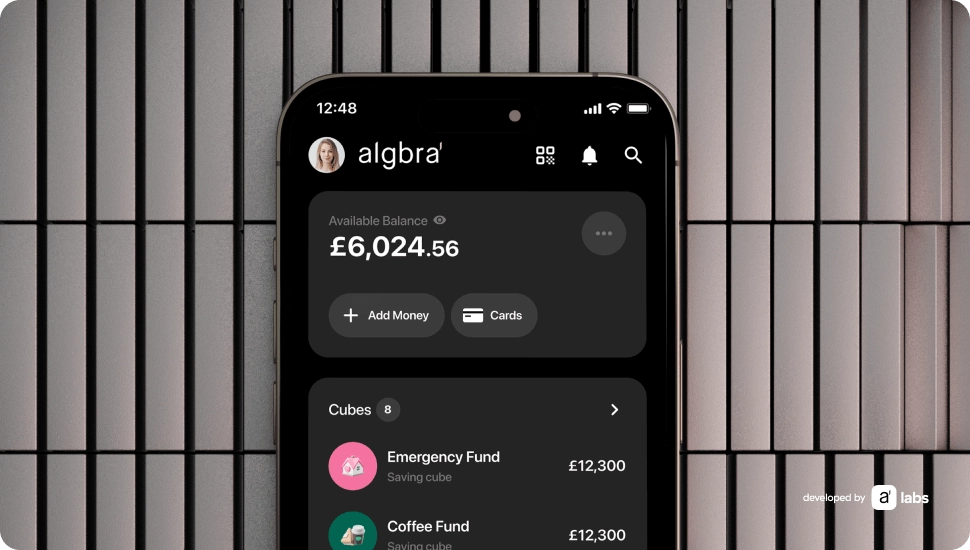

Algbra, a purpose-driven fintech, aims to improve fintech diversity. It has partnered with Mastercard in an attempt to better inform minority groups that have been overlooked by fintech companies. 1.7 billion people across the globe remain ‘unbanked’, meaning they cannot access a bank account or a mobile money provider. Education is crucial in order to make fintech more inclusive, and Algbra outlines its goal to enhance financial literacy amongst diverse groups. This involves offering current accounts, cards, investments and loan products, as well as producing content that “celebrates and empowers diverse identities and cultures”.

This is just one wing of Algbra’s mission to make fintech more socially conscious. Algbra acknowledges the interdependence of diversity and sustainability, with a focus on “globally overlooked and minority groups” that are disproportionately affected by the effects of climate change. Algbra is working hard to provide users with tools to facilitate ethically-minded banking. Aside from offering a sustainable card, through the Algbra app users can keep an eye on their carbon and water footprints and easily donate to a variety of charities. The company also pledges to not invest in industries that it deems to be unethical, such as gambling, tobacco and arms.

Nizam Uddin OBE, Chief Strategy Officer of Algbra, emphasises the company’s ambition to drive social change, “We need to recognise the interconnected nature of climate change and diversity - we cannot tackle one without the other. Through Algbra and our collaborations, we are working hard to ensure our financial system is the most inclusive and environmentally-conscious network of its kind.” In doing so, they are demonstrating that there is no need to view profitability and the responsibility to be socially conscious as being opposed: Algbra strives to accomplish both in tandem.

--

#FeatureByAlgbra.

Click here to read original article.